PROGRESS 2050: Toward a prosperous future for all Australians

Back to all opinion articles

19/04/2018

Life has changed significantly for young Australians over the last 40 years. Millennials now delay marriage and childbirth, increase their years of study and have much greater rates of part-time work.

As a result, millennials might be feeling a little hard done by, but Australians aged from 25 to 34 have actually enjoyed increases in their incomes compared to the population average. They have also done better than people the same age in other countries.

These are some of the findings of a report from the Committee for the Economic Development of Australia: How unequal? Insights on inequality. It questions whether young people today are likely to do as well economically as previous generations.

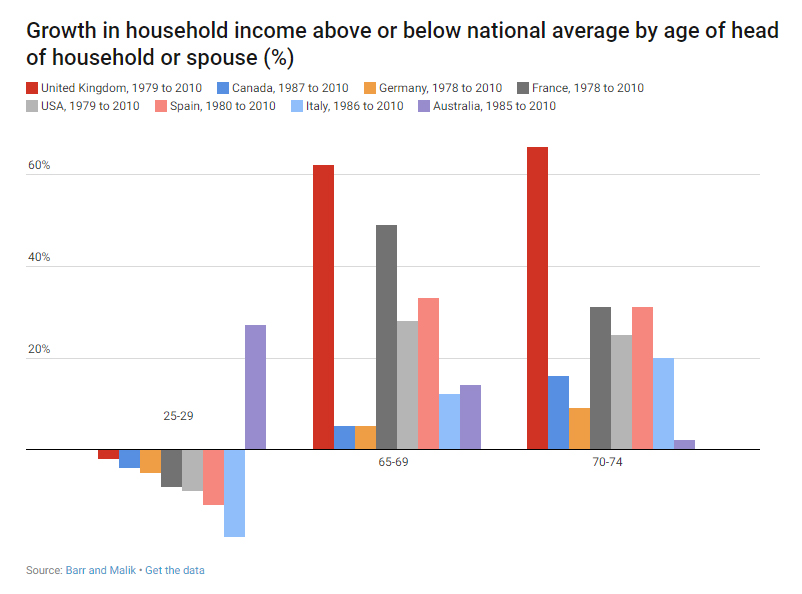

Early millennials, born between 1981 and 1985, experienced household income growth 27 per cent higher than the Australian average up to 2010, while households with a head aged 70 to 74 enjoyed growth only two per cent higher than the national average.

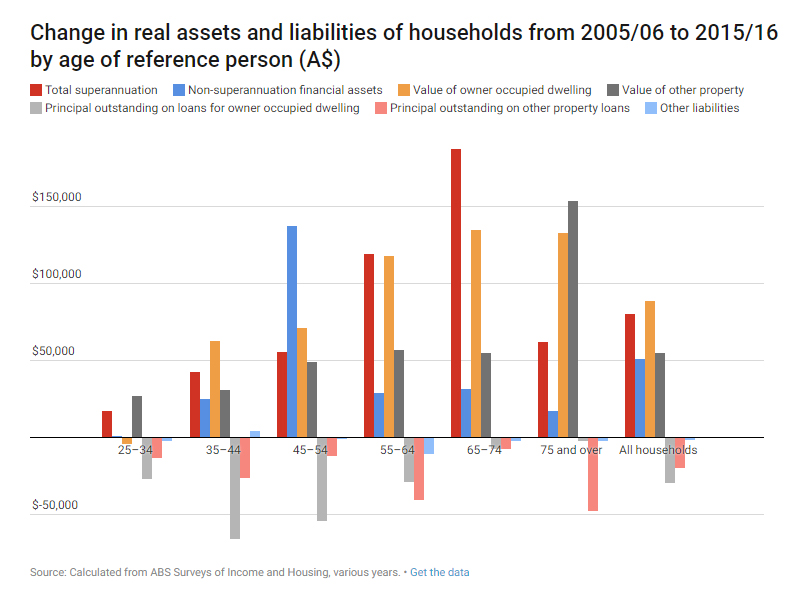

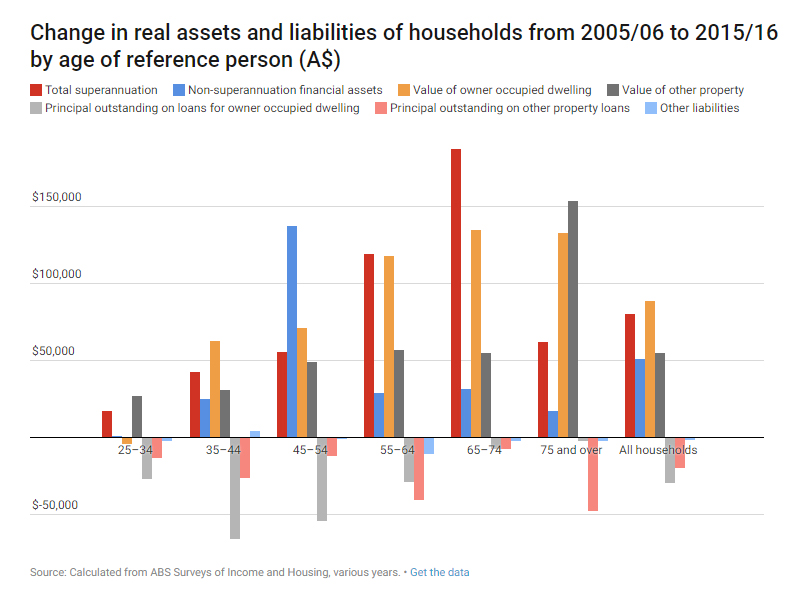

Although incomes might be higher, the picture of household wealth is different. The wealth of older Australians has increased much more rapidly than that of younger generations, due to both increasing superannuation wealth and increasing property wealth.

Incomes are better for Gen Y in Australia

Work by the Luxembourg Income Study found that in the United Kingdom, households with a head aged 25 to 29 years saw income growth two per cenet less than the overall national average in the three decades up to 2010. They also found households with a head aged 65 years and over enjoyed income growth more than 60 per cent higher than average.

In brief, in the UK older households became much better-off and younger households became slightly worse off than the population as a whole. Similarly young Americans experienced income growth nine per cent less than the national average, those in Spain 12 per cent less and in Italy 19 per cent less. In all these and other countries, older households have done better than the national average, although none as well as in the UK.

In contrast, younger Australians did better than the national average in income terms, and better than older Australians.

ABS data show that in 2016, Generation Y Australians had higher incomes between the ages of 25 to 34 than the preceding two generations – about 18 per cent higher than those born a decade earlier. However, the real increase appears to have slowed compared to the previous decade, that cohort had incomes 65 per cent higher than those a decade earlier (due to the mining boom).

Older Australians, born between 1941 and 1950 (including the first baby boomers), show an increase in average incomes between 1995-96 and 2005-06, and then a decline as they enter retirement. Middle baby boomers, born between 1951 and 1960, show a marked increase in real incomes between the age of 35-44 years and 45 to 54 years (from A$1,370 per week to A$2,200 per week). But they only experienced a very small increase in the next decade, because some of them retired before the age of 65.

Baby boomers born between 1961 and 1970 show substantially higher incomes than those born a decade earlier – more than 20 per cent higher in real terms at the age of 45 to 54 years. Generation X born between 1971 and 1980 show large increases in real incomes – nearly 45 per cent - across the last decade and are about 34 per cent better off than the preceding cohort were at the same age.

What has happened to wealth

Households with people under 35 years of age were actually slightly worse off in wealth terms in 2015-16, than a decade earlier, with their net worth falling by around eight per cent, according to Australian Bureau of Statistics data. But for those aged 65 and over, there were increases closer to 40 per cent in real net worth.

The value of owner-occupied housing fell for Australia’s youngest age group, but older households enjoyed large increases in the value of their homes and large increases in the value of other property they own.

Overall, all age groups saw real increases in the value of their total assets, including the youngest age group. This means that falls in wealth are due to an increase in their debts.

ABS data also shows that at all ages there has been a fall in the share of outright home owners, and also in the share of the youngest age group with a mortgage. For younger age groups an increasing share are private renters. This was a significant increase from 43 to 53 per cent for those aged 25 to 34 years and from 26 to 31 per cent for those aged 35 to 44 years.

For those 65 years and over, there has been little change - around 85% of households aged 65 years and over were owners or purchasers in both 2005-06 and 2015-16.

Younger households have seen both declining rates of home purchasing and higher overall indebtedness. Rental costs have also increased faster than the costs of home ownership, and this may have increased the barriers that younger generations face in establishing themselves in home ownership.

But when it comes to incomes, millennials in Australia have continued to progress.

CEDA research: Read and download How unequal? Insights on inequality.

This article was originally published on The Conversation, 20 April 2018 to coincide with the launch of CEDA's report.

CEDA Members contribute to our collective impact by engaging in conversations that are crucial to achieving long-term prosperity for all Australians. Find out more about becoming a member or getting involved in our work today.