Explore our Climate and Energy Hub

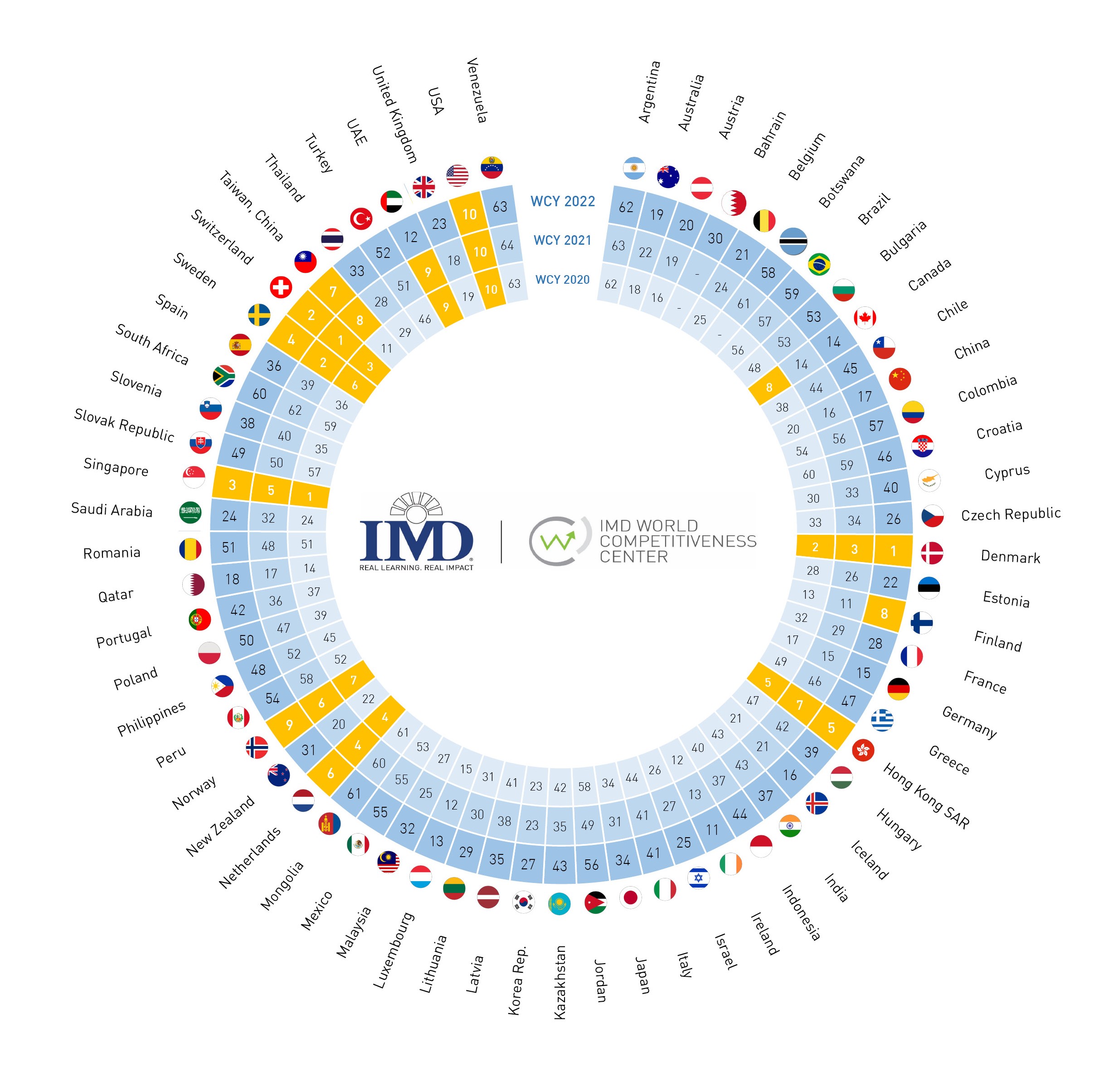

Australia’s competitiveness ranking increased three spots to number 19 out of 63 countries in the annual IMD World Competitiveness Yearbook. It comes after Australia received its lowest ever competitiveness ranking in 25 years in 2021.

“Australia’s terms of trade driven by strong commodity prices, employment numbers and pandemic recovery have saved the day – ensuring our international competitiveness ranking improved and did not slip further,” says CEDA CEO Melinda Cilento.

Australia’s worst result was in entrepreneurship, ranked 61 out of 63 countries. Australia also dropped from number 20 to 41 in terms of workplace productivity.

Australia’s strong terms of trade and pandemic recovery have boosted the nation’s international competitiveness ranking despite poor performance in the long-term drivers of competitiveness – entrepreneurship, technology and productivity.

Australia’s competitiveness ranking increased three spots to number 19 out of 63 countries in the annual IMD World Competitiveness Yearbook. It comes after Australia received its lowest ever competitiveness ranking in 25 years in 2021.

“Australia’s terms of trade driven by strong commodity prices, employment numbers and pandemic recovery have saved the day – ensuring our international competitiveness ranking improved and did not slip further,” says CEDA CEO Melinda Cilento.

“However, it is clear when compared against the top performing countries, that long-term and well-known weaknesses in the policy environment are holding Australia back.

“Australia’s future competitiveness is not assured without lifting our game on areas such as technology, energy, skills and training, entrepreneurship, tax and productivity.

“The rankings also suggest that Australia’s export concentration remains an area of vulnerability. Australia must lift its game on trade – diversifying its trading partners and continuing to build new markets for the goods and services in which we compete.”

The rankings suggest that Australia’s cost of living pressures are particularly acute – the nation was already ranked 49th in the world at the end of 2021.

“Current inflationary pressures are coming on top of an already uncompetitive cost of living environment,” says Ms Cilento.

Australia’s worst result was in entrepreneurship, ranked 61 out of 63 countries. Australia also dropped from number 20 to 41 in terms of workplace productivity.

“On the face of it, Australia’s short-term outlook is good but the IMD highlights that the critical pillars of competitiveness in a turbulent global environment are the institutional framework, infrastructure, and education – areas where Australia must now make very deliberate policy choices to underwrite future success.

“Australian companies are far less digitally advanced than their global competitors and information technology continues to be a much smaller contributor to our economy than other advanced economies.”

Only three percent of executives surveyed said that Australia was cost competitive and five per cent believed Australia had a competitive tax regime.

The three most important trends considered to be impacting businesses in 2022 as ranked by executives were inflationary pressures, geopolitical conflicts and supply chain bottlenecks.

The top five countries in the overall rankings were led by Denmark, Switzerland, Singapore, Sweden and Hong Kong. Australia was ranked number 19, behind Iceland in 16th place, China in 17th and Qatar in 18th.

The World Competitiveness Yearbook is produced by IMD, in partnership with local partner institutes. CEDA is the Australian partner.