Explore our Climate and Energy Hub

15/05/2024

The Albanese Government’s third Budget delivers broad-based cost-of-living support, but despite the Government insisting it will help bring down inflation, its spending measures risk stoking price pressures in both the short and long term.

While its previous Budgets struck a good balance between supporting vulnerable Australians and fiscal repair, there is little in this Budget to address the medium-term structural deficit.

As expected, this Budget will deliver a modest surplus of $9.3 billion in 2023-24. This will be short-lived, however, with forecasts for deficits of $28.3 billion in 2024-25 and $42.8 billion in 2025-26.

The deterioration is largely due to higher spending on cost-of-living measures and what the Government is claiming are “unavoidable” spending measures, including support to Services Australia and extending underfunded health programs.

The strong labour market and high commodity price forecasts see projected tax revenue $27 billion higher over the forward estimates than projected in MYEFO. Higher spending on cost-of-living support, the care economy and Future Made in Australia are increasing the Budget spend over the period.

With inflation remaining persistently higher than the Reserve Bank’s 2-3 per cent target, the Government has delivered more cost-of-living relief through electricity rebates to all Australian households.

Despite the Government’s claim that these rebates will bring down headline inflation, their broad nature, coupled with the Stage 3 income tax cuts, will likely add to inflation, particularly without commensurate spending cuts elsewhere.

The budget papers say these measures, as well as higher real wages, will strengthen the purchasing power of households. But if they spend this money instead of saving it, inflationary pressures will be hard to avoid.

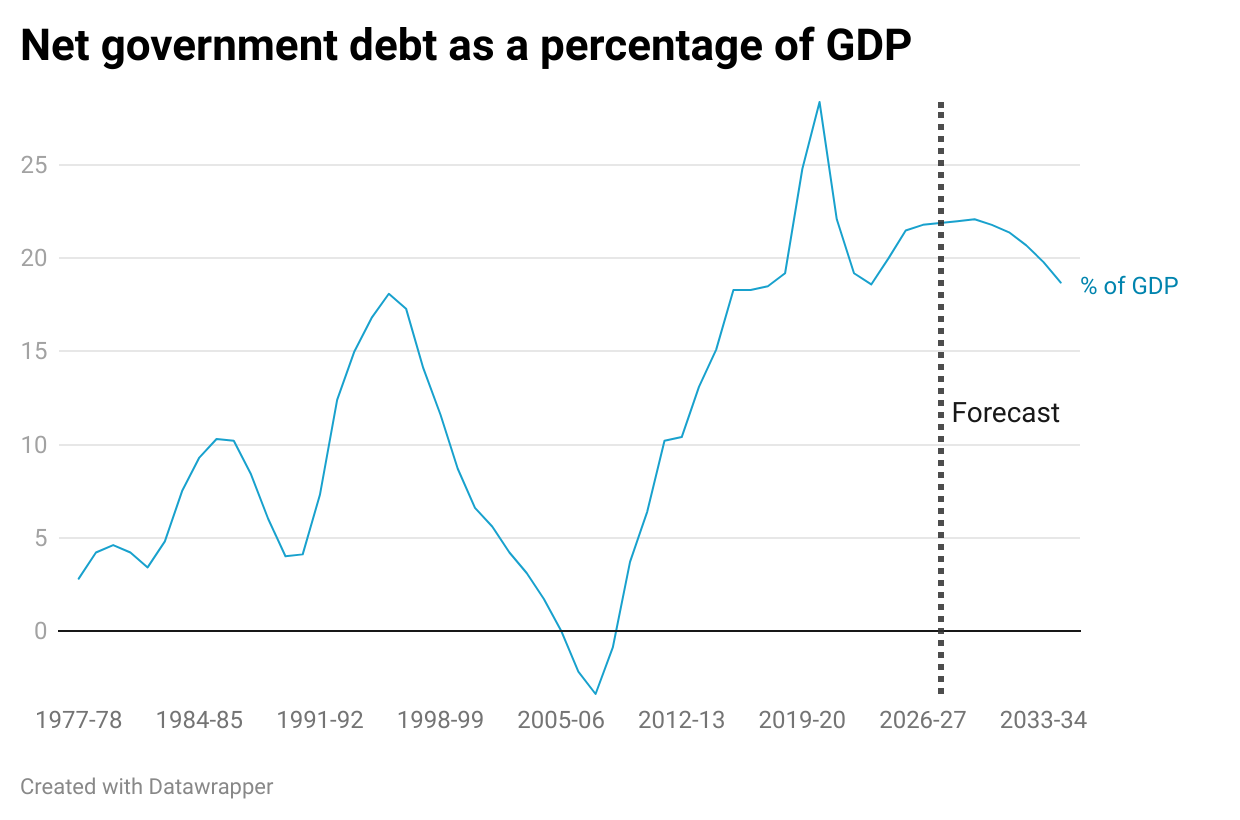

Government debt is forecast to remain relatively low, although slightly higher across the forward estimates than forecast in MYEFO. Net government debt is forecast to peak in 2029-30 at 22.1 per cent of GDP.

.png)

What does the Budget say about the economy?

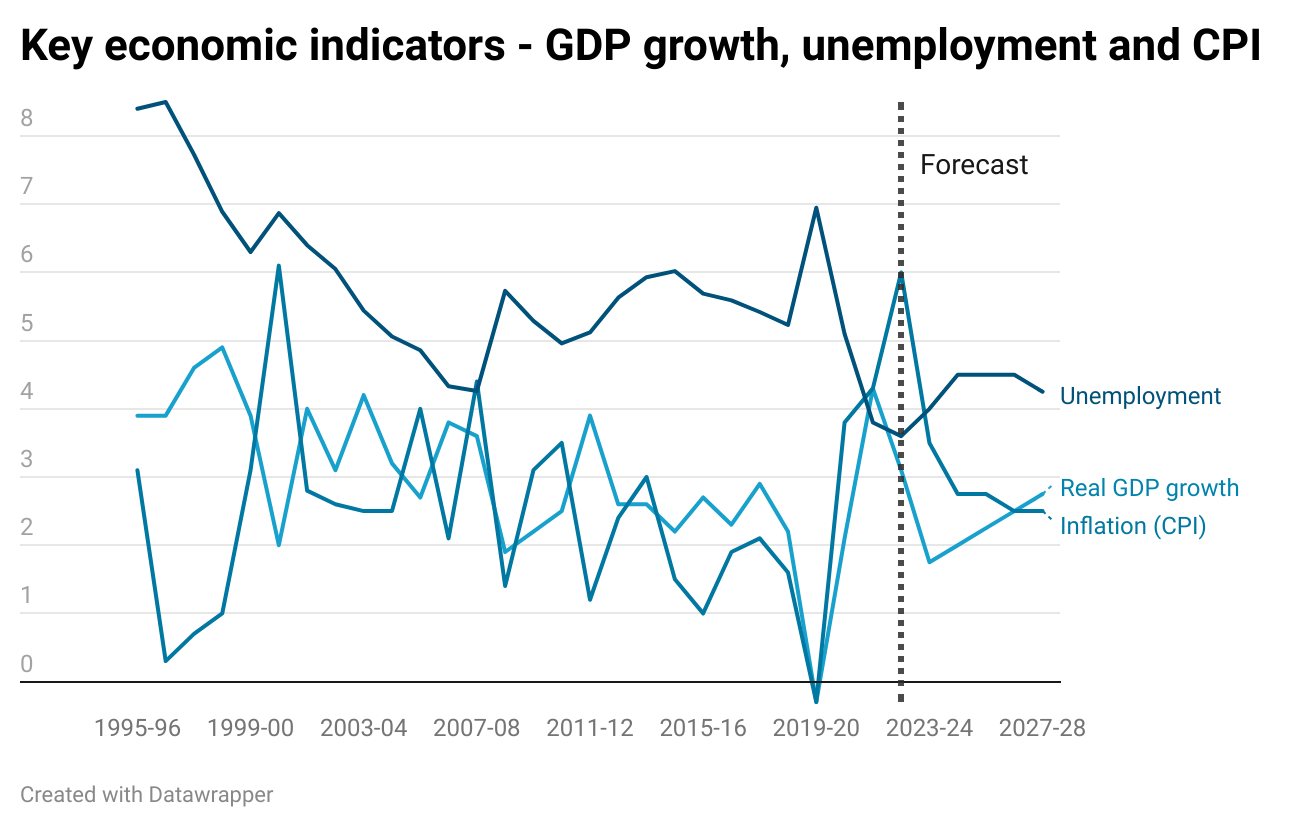

Economic growth through 2023-24 has been weak, slightly lower than forecast in last year’s Budget, with real GDP growth sitting at 1.75 per cent over the year. The Budget forecasts growth will rise to 2.0 per cent in 2024-25 and 2.25 per cent in 2025-26.

Unemployment has remained surprisingly low despite the fight to reduce inflation, but is forecast to increase modestly to 4.5 per cent in 2024-25. Coupled with lower migration forecasts, this points to a still tight labour market.

Inflation is forecast to return to the RBA’s target range in 2024-25, this looks ambitious and is more optimistic than the RBA.

.png)

What does this Budget do for spending?

Spending has increased by $45.8 billion over the forward estimates, mainly to alleviate cost-of-living pressures, further the decarbonisation agenda and support housing projects. This risks further entrenching the long-term structural deficit.

The main spending measures are:

- Future Made in Australia – $22.7 billion;

- Building new homes – $6.2 billion;

- Electricity bill rebates – $3.5 billion; and

- Increases to Commonwealth Rent Assistance – $1.9 billion.

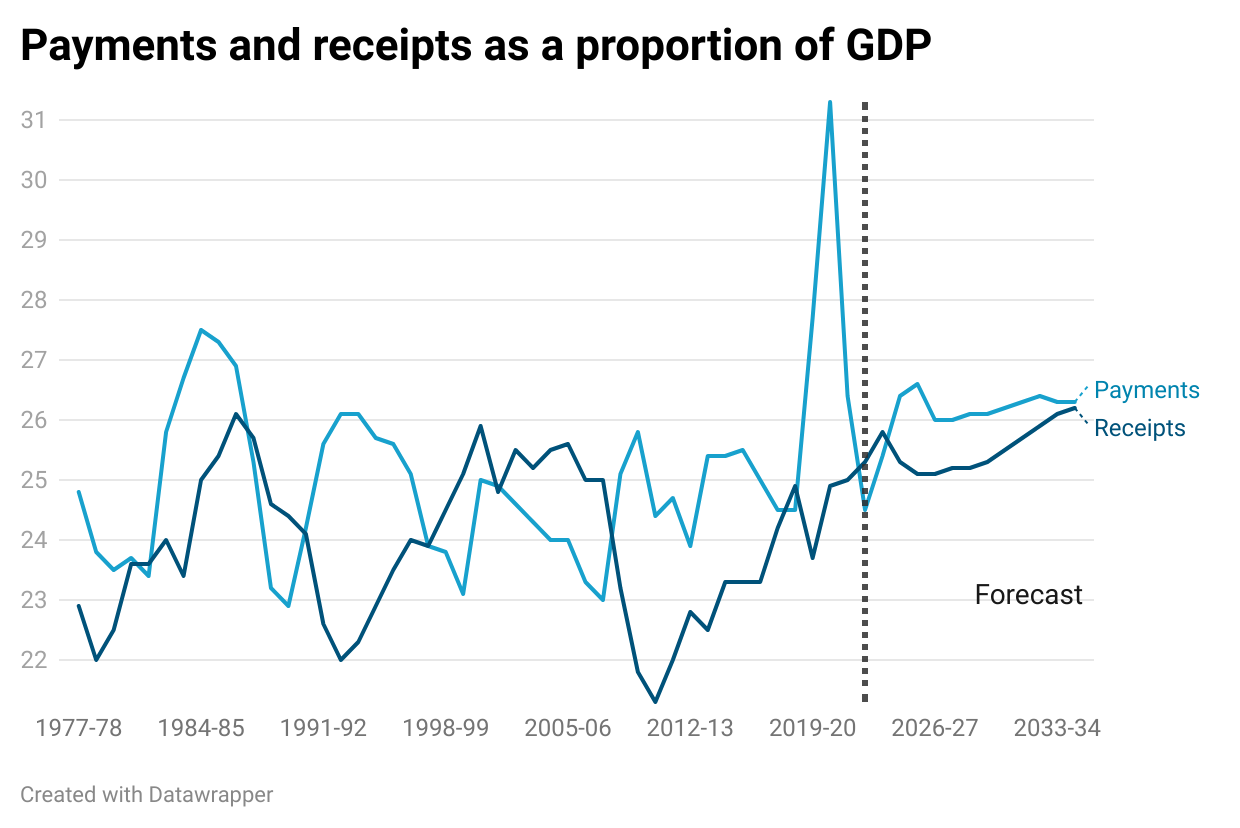

In aggregate, the Budget forecasts Government spending to be around 26.4 per cent of GDP in 2024-25 and to marginally decline over the forward estimates to 26.0 per cent in 2027-28. Growth in “unavoidable” spending is the obvious risk.

What does this Budget do for revenue?

The Budget forecasts only slight increases in revenue over the forward estimates compared to MYEFO. Forecasts of slightly higher tax revenue from individuals and through company taxes, mainly in the resources sectors, rely heavily on both the labour market and commodity prices remaining strong, which helped revise revenue estimates upwards by $31.8 billion over the forward estimates.

The main revenue increases in the Budget are:

- Increased company tax receipts reflecting commodity prices and strong corporate profits – $26.2 billion;

- Income tax withholding reflecting strong labour market - $21.6 billion; and

- Policy decisions increasing non-tax revenue - $3.2 billion.

Provided the Budget parameters hold, tax revenue is forecast to be around 23.3 per cent of GDP in 2024-25, staying at that level through the forward estimates.

What does this budget do for productivity and long-term growth?

While the focus on the energy transition and decarbonisation is positive and much-needed, it is not yet clear whether direct investments made under the new $22.7 billion Future Made in Australia policy will go towards projects with the best prospects of sustainable comparative advantage.

This spending should focus on driving productivity by building the long-term fundamentals that underpin innovation. Enabling an environment conducive to investment is critical. Genuine tax reform, beyond the Stage 3 tax cuts, and simplifying the regulatory environment for many businesses, would be a good start.

Energy

The Government says Future Made in Australia aims to incentivise private investment, not replace it.

To be successful, it must have clear objectives, undertake transparent and independent analysis upfront, focus on innovation and emerging technologies, and include regular evaluation of policy. The National Interest Framework is a good starting point but must be robustly implemented.

Some measures, such as funding to build solar panels, are unlikely to be an efficient allocation of spending.

Migration

The Government has marginally reduced the permanent migration cap as it seeks to balance the need to fill ongoing skills shortages with community confidence in and support for our migration system.

The soft cap on international student numbers also reflects this need, while acknowledging the importance of international education as one of our key exports. The Government should work with the sector to ensure this policy does not bring unintended consequences.

We continue to believe the Government should create an essential skills visa focused on workers in the care sector to ease persistent worker shortages in these critical roles.

Aged care

Aged care is the fourth-biggest area of Government spending, with annual funding rising to $40 billion annually by 2026-27. But the sector desperately needs funding, investment and reform.

It is disappointing the Government still has not announced a comprehensive response to the recommendations of the Aged Care Taskforce. Australia won’t be able to provide quality care for older people without a financially sustainable system that can attract the additional investment required.

It is reasonable that, where they can afford it, older Australians contribute more to their care by paying for daily living costs such as cleaning, food and activities. The Government should also consider including the family home in means testing for aged care. In addition to helping with funding, it would also treat homeowners and renters more equitably.

The Government should also release more home-care packages that afford appropriate levels of care. There are nowhere near enough packages to meet the current waiting list.

Housing

The $6.2 billion in new commitments is much needed to address the growing housing crisis. It is good to see much of this going towards social housing. But there are still many hurdles to delivering more housing, including planning and zoning regulations and the lack of available construction workforce.

There is little sign of meaningful progress on the Housing Accord – which has a target to build 1.2 million homes over five years from mid-2024. More can be done to address the shortages in the short term, including repurposing existing buildings and increased use of modular housing builds.

The increase to Commonwealth Rent Assistance is very welcome and well-targeted to support vulnerable renters while limiting additional inflationary pressure.