PROGRESS 2050: Toward a prosperous future for all Australians

21/08/2024

Gross state demand is barely keeping pace with population growth in Queensland, CEDA Head of Research Andrew Barker told a CEDA trustee event last week.

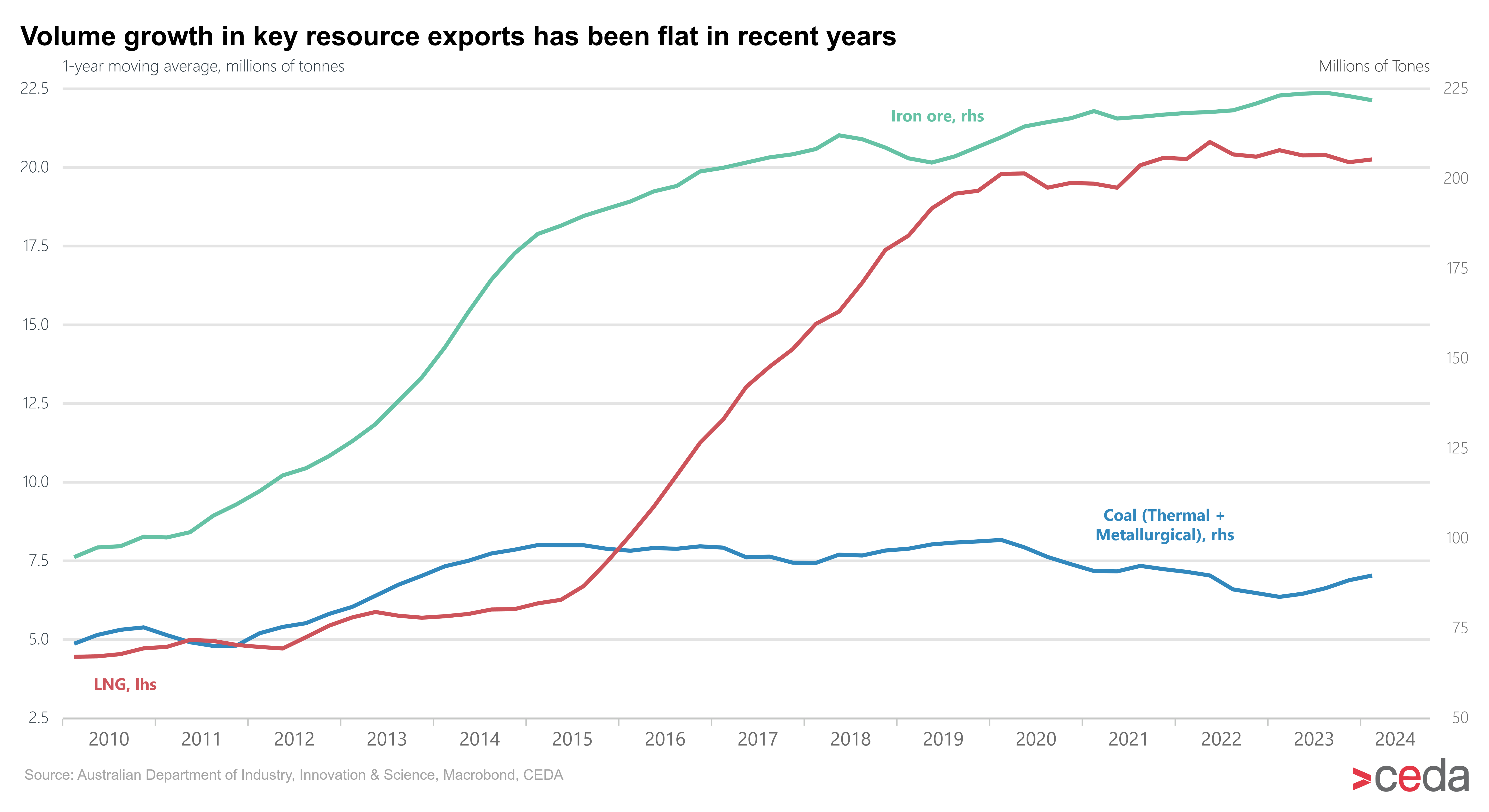

Nationally, GDP growth is also weak, at less than two per cent a year, due to weak productivity growth and a lack of strong export growth.

“We haven't had strong export growth driving our economy,” Mr Barker said

“Some of our key commodities where we saw a real boom historically were in iron ore exports, during and just following the mining boom, and an increase in LNG exports here in Queensland.

“They've been pretty flat through the pandemic and in recent years there have been some high prices, but the volumes have been pretty flat.”

Housing affordability is a key concern, with house prices in Brisbane recently overtaking Melbourne and Canberra.

“Brisbane is now clearly the second most expensive city in which to buy a home, which is a bit concerning because Queensland has the sixth highest household income per capita.” Mr Barker said.

The ratio of house prices to income has increased dramatically in Brisbane over the past few years, placing the city between London and New York for affordability.

At the same time, insurance costs are increasing, up about 15 per cent in the past year.

“That's important for Queensland, particularly in northern Queensland,” Mr Barker said.

“It’s not that they're growing faster than elsewhere, but they’re coming from a higher base, which has a bigger effect.”

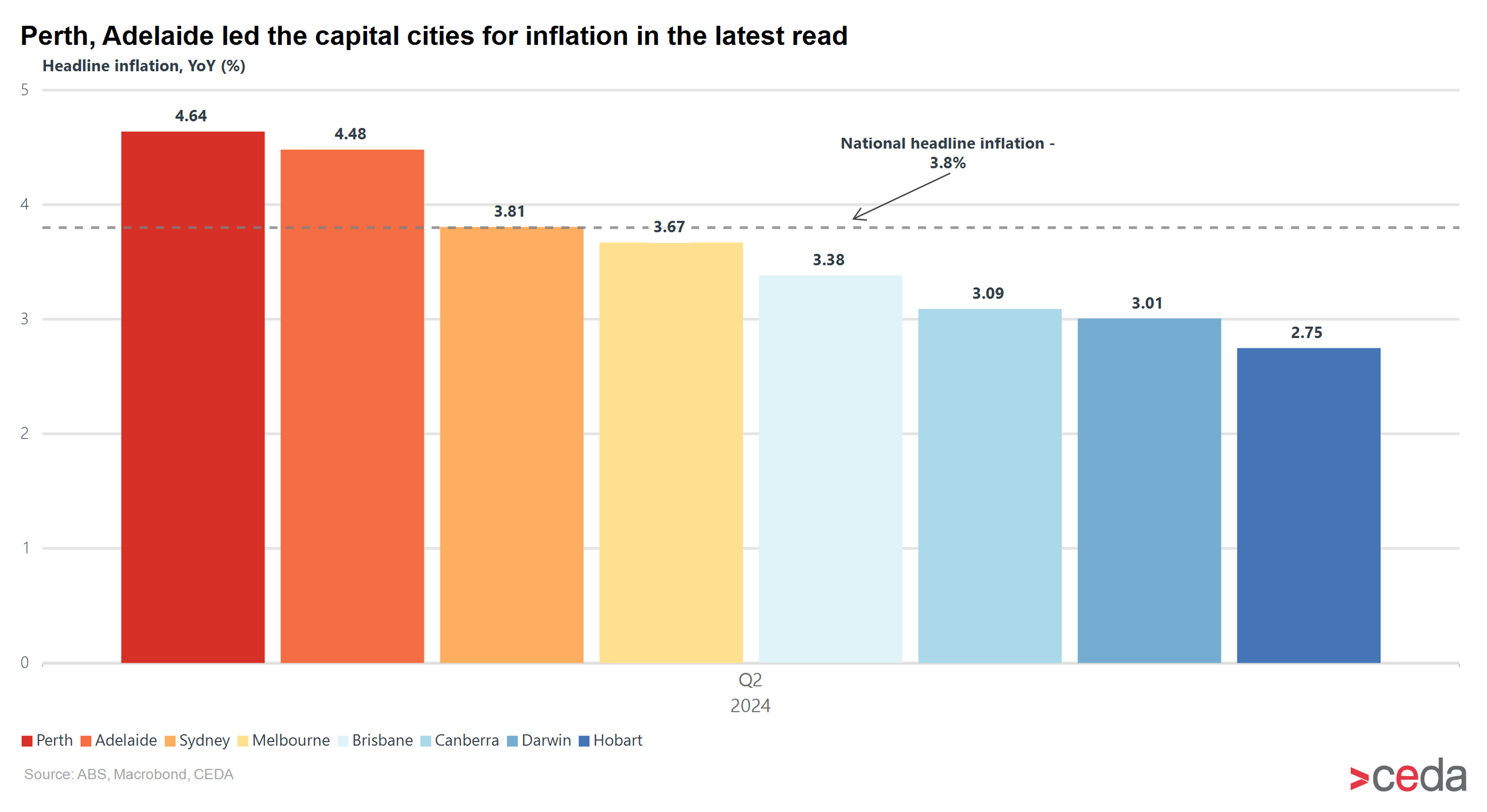

Brisbane’s annual rate of inflation came in at 3.4 per cent in the June quarter, below the national headline rate of 3.8 per cent.

“That's despite the bigger effect of insurance growth, and it's despite pretty strong growth in travel costs as well, including international travel costs.”

Mr Barker explained that the lower inflation rate in Brisbane can be partially explained by larger electricity bill rebates in Queensland, which reduced the overall CPI reading.

“That can be expected to come back up as those eventually stop in future years,” he said.

Despite a recent uptick in the unemployment rate, Mr Barker said the national labour market had been surprisingly resilient in a slowing economy.

“We haven't seen a big increase in unemployment compared to some of the previous cycles, and this recent increase in unemployment has been relatively small,” Mr Barker said.

“Labour force participation is still really strong, which is great, and we have an inclusive labour market where people can get jobs.”