Explore our Progress 2050 Goal Tracker

23/08/2024

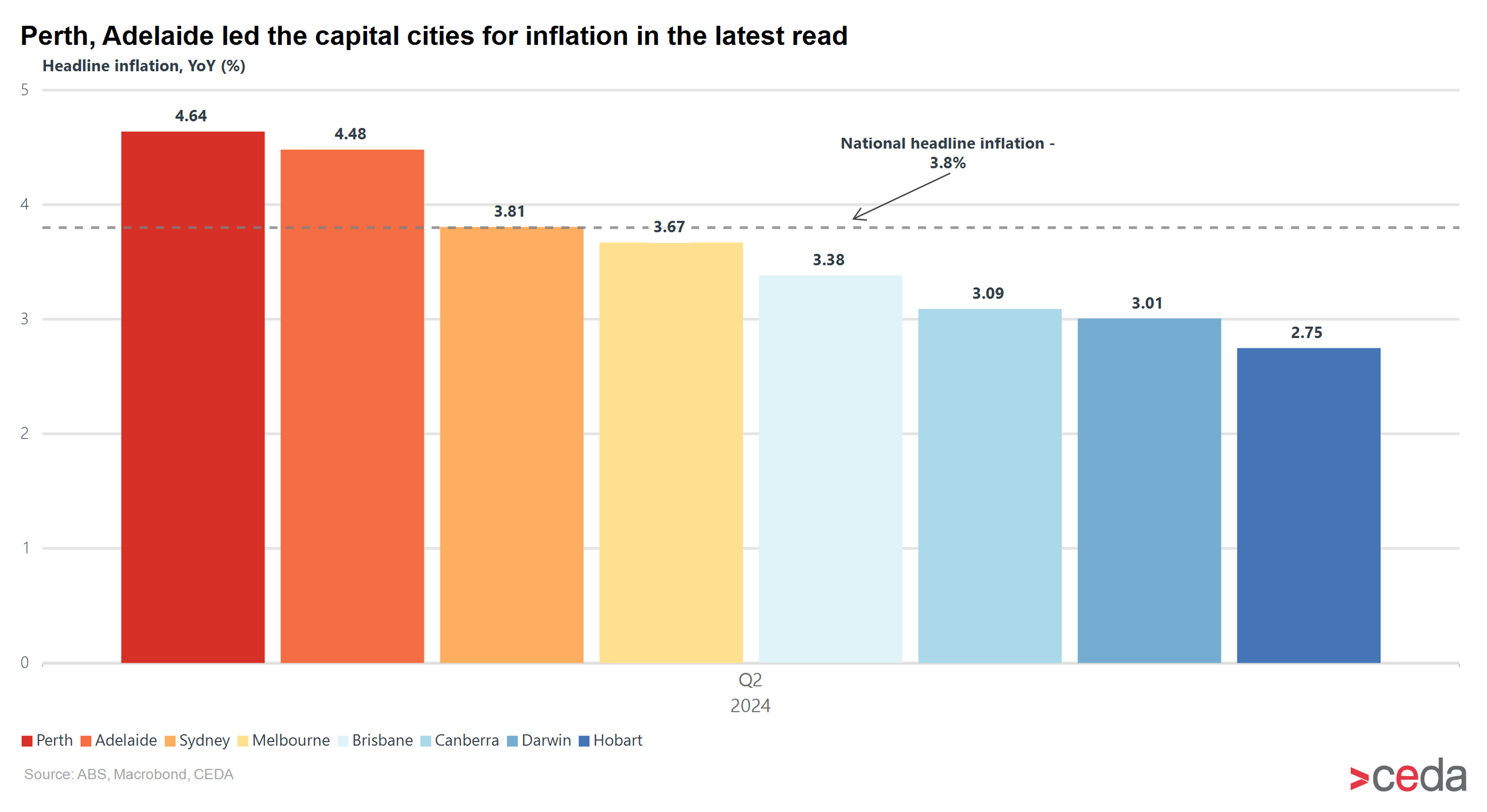

Inflation remains a concern in Sydney, CEDA Senior Economist Tim Kane told a CEDA trustee event last week.

Sydney’s Consumer Price Index tracked close to the national average in the June quarter data release.

“It's not a surprise given the amount of economic activity that happens in Sydney,” Mr Kane said.

“The overall price index for Sydney has followed a pretty similar pattern to what we see nationally, and it is starting to come back.”

Reserve Bank Governor Michele Bullock flagged the RBA was considering a rate rise at its last meeting, and Mr Kane warned that was more likely than a cut in the near future.

“My sense is that the Reserve Bank is going to be very hesitant to raise rates again,” Mr Kane said.

“It is much more likely that they will go up before they go down, but they will be very hesitant unless they have a really strong cause to do so.

“Thankfully, the last figures for inflation were not strong,” he said.

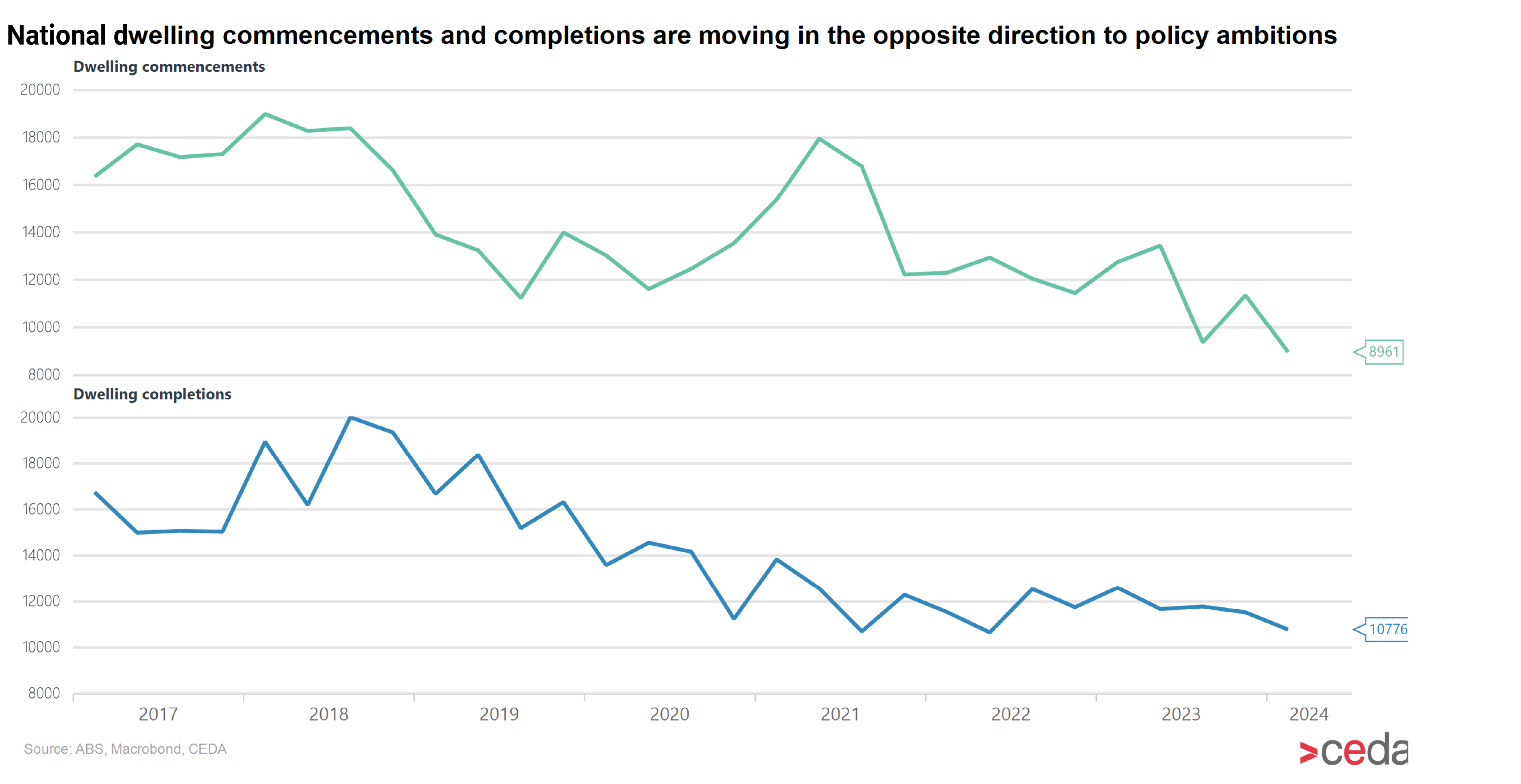

Housing commencements and completions have stalled around the country despite the current housing crisis, but this differed across dwelling types.

“Houses have been pretty steady on the long-term average. It's been apartments and townhouses where the levels have been dropping away,” Mr Kane said.

“This is very similar in New South Wales, but to give you some sort of context, in NSW’s case, in the first six months of 2024 new dwelling approvals were down 32 per cent on the first six months of 2019.

“We're in a housing crisis but we're approving 30 per cent fewer houses than previously.”

Weak productivity growth has been a sustained issue and in 2023 Australia’s multifactor productivity, a measure of how we use labour and capital inputs, declined by 0.5 per cent.

“NSW multifactor productivity has actually been even more sluggish – it's declined by 1.64 per cent over the same period, which obviously has huge implications for the economic outlook in the state,” Mr Kane said.

NSW Government debt is set to rise rapidly and is forecast to reach nearly $200 billion by June 2028.

“This is much higher debt than eight or 10 years ago when there wasn't any government debt,” Mr Kane said.