AI Leadership Summit 2025 Highlights

Foreword

Australia’s long history of economic success and broader prosperity has been shaped by our ingenuity and particularly by our ability to leverage science and technology to enable new opportunities and competitiveness. There are plenty of well recognised examples; from ultrasound, to Wi-Fi, cochlear implants, polymer bank notes, the cervical cancer vaccine and the space industry opportunities that trace to remote automation in our resources sector.

Similarly, the success of companies like Atlassian, Canva and Afterpay is increasingly being woven into our national narrative.

While our ability to harness both science and technology has always been important, arguably the centrality of this to future prosperity has never been greater. Further, the fields of science and technology are separate, yet highly complementary. Imagine if we were able to better combine them to power innovation - for the multiplying effect of Science x Technology.

Against the backdrop of rapid digitisation and technological advance, the ability to genuinely and consistently innovate, to translate insights and ideas to valued, sustainable products and services is of course central to competitiveness and economic growth. The significant challenges and opportunities facing Australia – population ageing, climate change, geopolitical instability – against the backdrop of COVID legacies, further underscores the critical role of our science and technology capabilities and our ability to leverage these.

All of this serves to remind of the importance of ensuring that our science, technology and innovation efforts are delivering all that they can. There is certainly a lot of energy behind many initiatives, and many successes. However, there is a strong sense that more could and should be achieved across all sectors and the country, and that we need to move beyond replaying well-rehearsed problems and narratives. More fundamentally, there is a desire among many to ignite greater ambition, excitement and imagination around our science and tech possibilities as drivers of future prosperity, and to bring business, academia and government together in this pursuit.

CEDA is excited to be working with its members and other important stakeholders in this project to do just that. I hope that this is the first chapter of what will be a meaningful effort to capture the important windows of opportunity open to us now.

Melinda Cilento

Chief Executive Officer, CEDA

Executive summary

Imagine...

It’s 2050, and Australia is widely recognised for its world leading research and innovation, the sophistication and diversity of its businesses and exports, and its ability to use science and technology (SxT) to create new industries, skills and jobs, and improve environmental sustainability and wellbeing. The foundations for these achievements were established in the aftermath of the COVID-19 pandemic, when business, academia, government and community sectors worked together to develop an ambitious and explicit approach to guide decision-making and investment to better leverage science and technology to capture emerging opportunities.

In mid-2022, CEDA convened a series of workshops and one-on-one discussions with leaders from Australian industry, government and academia on how our nation might better harness Australia’s science and technology potential to drive innovation and economic growth.

This question is a complex one. Sitting beneath it are many different stakeholders, perspectives and objectives. This diversity, in the absence of clear, overarching ambitions and frameworks to connect disparate perspectives, priorities and programs is in fact the key challenge for policy, industry and academic leaders seeking to enable and harness the full potential of Australia’s science and technology capabilities.

Over recent decades there have been many efforts to advance this ambition, under the guise of national innovation policies or strategies. Speaking frankly, many who have been involved in previous efforts will remark on the repetitive consistency of the issues raised and narratives that have cycled from the broad to specific and back again. In an effort to drive overarching thinking and frameworks, some have identified that past efforts have sought to ‘boil the ocean’, with the result that recommendations were too high level or unwieldy, and difficult to implement much less communicate in a way that garnered community interest, excitement and support. In response to an inability to progress broader agendas, stakeholders have alternatively focused on ‘innovation’ in the context of their narrower objectives and areas of expertise, which has resulted in an often disjointed debate where many are seemingly having the same conversation but speaking different languages.

CEDA members believe it’s time for a new, shared conversation. One that reflects past mistakes and moves beyond well-trodden narratives focussed on what we can’t do. Instead, we need a conversation that brings a ‘can do’ attitude and ambition to industry and innovation policy. Such an approach must acknowledge and involve roles for all stakeholders, including industry. This work sets out to ignite, but not solve, this challenge.

A number of key themes emerged from our work; the most prominent being a very clear desire for a compelling national ambition that connects industry, innovation and science priorities and strategies and essentially describes what success looks like for Australia. The ambition should be supported by a framework to guide investments, initiatives and evaluation.

Underpinning this desire is a recognition that many of our businesses are slipping further from the global technology frontier and that the sophistication of Australia’s industries and economy is declining. Further - that this is happening at the precise time we need a step up in our industrial and innovative capability in response to critical mega trends as neatly set out in CSIRO’s recent Our Future World report.1 That the rest of the world is leaning into these very same challenges underscores the importance of clear direction and targets, consistent effort and constant evaluation...in other words, greater Captaincy.

Our experts also agreed that any refreshed national industry, innovation and science ambition requires two critical supporting elements. First: a similarly turbo-charged focus to build the capabilities of Australia’s population (from the earliest years through to continuing / further education for the current workforce) to enable and inspire innovation-focused thinking and skills. Second: a significant and sustained lift in collaboration between the members of the innovation ecosystem.

There was a strong sense through these conversations that for too long industry had looked to government and universities to lead the way. Our industry leaders [participants] agreed that there is a significant opportunity and need to sharpen and energise the role of business in this discussion.

Throughout all of our discussions one key characteristic emerged consistently - a sense of optimism, enthusiasm and determination to grasp the significant opportunity that harnessing science, technology and innovation offers for Australia. With our ingenuity, skill and determination, Australia has all the foundations in place to become a world innovation leader by 2050.

ABOUT THIS PAPER

With this paper, CEDA has sought to employ its convening power and independence to curate a distilled, cross-sector view of Australia’s innovation opportunity as it stands today.

This paper does not attempt to provide detailed answers. But based on what we learned and heard in these discussions, we have generated some clear insights and recommendations for a path forward. CEDA offers these insights to the national conversation as a contribution and base for further work by us and others.

There is significant momentum and opportunity building in Australia around this topic. The government’s National Reconstruction Fund, the recent Jobs and Skills Summit and the emerging discussions on how to fund more ambitious social and economic investments in Australia.

Microsoft ANZ CEO Steven Worrall shares key themes from the Science x Tech paper

_1.png)

Science X Technology

to drive Australian innovation and growth

Insights

Captaincy

To generate a future economy fuelled by innovation, the nation needs a clear, nonpartisan, long-term industry and innovation ambition. This must be a shared ambition backed by accountability for leading and driving the many innovation ‘teams’ that will ultimately deliver on that ambition.

The Captaincy opportunity

Australia has a strong history of ingenuity. Yet questions about ‘What next?’ are often impeded by long-running, well-traversed debates. Key planks of these debates include: the ‘right size’ or scope of innovation base for Australia reflecting the scale of our economy and population; accountability for driving and funding research and its translation to commercial and social value, and more broadly, questions around the ultimate purpose or end game of innovation investments. The lack of clarity and prioritisation of these issues on the national agenda has contributed to a lack of Captaincy.

At a government level, federal research and development policy has largely fallen between the education and industry portfolios.2 This separates science and public sector research policy from education research engagement, research grants and university policy. Without a shared national ambition, there is greater likelihood of misaligned priorities.

The average time between publishing academic research and its effects on productivity growth in the relevant industry is roughly 20 years.3 In the past 20 years Australia has had eight elections, seven prime ministers and three changes of government. There have been nine ministers responsible for innovation in the past nine years.4 The average lifespan of a federal R&D funding program under $1 million is just six years.5 The policy approaches and commitments to innovation in other countries are far more stable and consistent.

In the US for example, the SBIR grant program has survived seven presidential administrations largely unchanged.

There is broad agreement among researchers, industry and investors that Australia’s policy timeframes are too short; new programs and commitments are often not given the time to be proven and political cycles do not incentivise long-term thinking.

Against this backdrop of changeable and relatively short-term policy, universities have also faced a steady decline in government funding. They have sought to fill funding gaps through international student enrolments and international research partnerships. Accordingly, international funding for Australian university research has grown exponentially6 since 2000.

As of 2020, the OECD average for gross domestic spending on R&D sits at 2.6 per cent of GDP, Australia sits at just 1.8 per cent. Meanwhile, the leading nations of Israel, Korea and Sweden spend 5.4 per cent, 4.8 per cent and 3.5 per cent respectively. While most nations have increased funding in the past 10 years, Australia has declined from 2.1 per cent in 2011.7 The decline is attributed to sharp falls in business expenditure on R&D in the mining and manufacturing industries while government investment in R&D has been relatively flat.8 At less than 1 per cent of GDP, business spending on R&D in Australia is significantly lower than the OECD average of 1.67 per cent of GDP.9

Figure 1

Gross domestic spending on R&D

Source: OECD (2022), Gross domestic spending on R&D (indicator). doi: 10.1787/d8b068b4-en

Australia is home to some of the most prestigious and productive universities in the world and is responsible for 2.7 per cent of the world’s scientific output, despite being home to just 0.34 per cent of its population. Our research is also high quality, with 85 per cent rated at or above world standard.10

In conversation with CEDA members, we observe that Australia’s private sector expresses a high appetite to invest further in research. The business case is clear: recently published research from CSIRO conservatively estimates that $1 of R&D research in Australia creates an average of $3.5 in economy-wide benefits and an average 10 per cent average annual return.

Assuming existing capital can be utilised, CSIRO finds that the benefits could be even higher, with $1 creating $4.9 in economy-wide benefits and an average of 24 per cent annual return.11

But with a strong preference for applied research that can be developed and commercialised relatively quickly to realise return on investment, industry finds itself misaligned with the longer-term foundational work necessary to build a rich base for future development.

It is increasingly clear that industry also struggles when it comes to enabling ‘captaincy’ and ambition within their organisations. CEDA’s work revealed, for example, how challenging it is to present credible or supportable innovation business cases within the context of the standard frameworks for assessing business opportunities.

Specifically, the uncertainty associated with expected timelines to deliverability and potential benefits for transformative innovation are hard to translate to a standard net present value assessment approach. This also makes it challenging to prioritise opportunities and investments. This explains a desire for ‘near to commercialisation’ ideas and insights but may ironically reduce the ultimate value of these by not having been involved in development along the way.

Better alignment of innovation and investment horizons would be enabled by clear and consistent national captaincy.

Looking ahead it is clear that the biggest challenges and opportunities facing Australia require greater investments in (and leveraging of the insights of) science and technology. Whether that be to manage decarbonisation of transport, improving waste management, or meeting the increasing care expectations and needs of an ageing population. Added to this, the challenges of COVID and emerging geopolitical dislocations have heightened the focus on security, resilience and sovereign capabilities. Among other things, spending on defence R&D will surely increase. How we make the most of this in every sense of the word, will depend on the ambition of political decision makers.

As the experience of others clearly shows, there is immense opportunity here with the right captaincy.

A new Australian innovation policy will require strong ambition and collaborative leadership across government, academia and industry. It should be guided by clear national ambitions about what kind of economy and industries we want – in other words industry policy and stewardship. And it will be essential to bring the public on board through a compelling narrative and to develop a social license for new technologies as they emerge.

Australia is responsible for

2.7%

of the world’s scientific output,

despite being home to just

0.34%

of its population.

Enablers of innovation Captaincy

Countries we look to as exemplars clearly define and promote their innovation aspirations. Silicon Valley, for example, began as a centre for weapon systems development and has benefited and grown from consistent government and industry commitment over decades.12 Australia has much to learn from international examples, particularly nations with a similar economic profile.

Policy commitment and consistency

One of the clearest and immediately actionable international examples is the value of policy consistency. It takes years for basic research to translate into a commercial outcome. There can be a 20-year lag between academic research and productivity growth in the relevant industry. For private R&D, there can be a delay of 3-6 years between investment and product introduction. For paradigm-shifting technologies, such as Wi-Fi, or the Internet of Things, the lag can be even longer, as supporting infrastructure, regulation and markets must first be developed.13

The United States’ Small Business Innovation Research (SBIR) program has been largely unchanged since its introduction in 1982, which has given industry the confidence to rely on it as a resource. With 97 per cent of Australian businesses operating with fewer than 20 workers (as of 2021), the SBIR program presents an eminently replicable formula for supporting small and medium-sized enterprises (SMEs) in R&D. Further examples of supporting transformative research in the US include groups such as the US National Science Foundation, which supports basic research that has resulted in transformative advances in science and engineering (such as bar codes, CAD, or the confirmation of the existence of black holes). Additionally, the US Government’s Advanced Research Projects Agency in its Department of Energy was established to advance high-potential, high-impact energy technologies that are too early in development for private sector investment (ARPA-E 2015). ARPA-E funds research that can have ‘transformational impacts’ rather than ‘basic or incremental’ research, and is modelled on the US Government’s Defense Advanced Research Projects Agency (DARPA), which is credited with such innovations as the GPS, the stealth fighter and computer networking.

In Europe, partnerships between government, industry and universities are more common than in Australia. Germany also allocates technical specialisations to its universities to develop ‘clusters of excellence’ and avoid unnecessary overlap.14 Many countries have also established centralised research and innovation agencies, such as the IIA in Israel or the DFG in Germany.

Consistent policy drives confidence, and therefore investment.

Australian federal climate policy over the past decade illustrates the consequences of policy ambiguity. Following the repeal of the Clean Energy Act 2011 in 2014, businesses were faced with years of uncertainty over whether the federal government would support any future green technology R&D or implementation. This was compounded by the protracted and public struggle over the National Energy Guarantee in 2018.

While Australia faced a decade of uncertainty over future climate policy, in 2019 the European Union committed to a 55 per cent reduction in emissions by 2030, at an estimated cost of €28 trillion.15 To industry, the commitment is a clear signal of the EU’s seriousness on climate and creates a business environment in which it is safe to invest in green R&D. For multinationals, the value proposition of whether to invest in green projects in Australia or Europe is clear. And while the debate can become stalled in hand-wringing about Australian cultural risk-aversion, the reality is that if policy settings discourage risk-taking, and reward short termism, the subsequent behaviours are likely to be risk averse, whatever the underlying culture.

For academics, entrepreneurs, and start-ups, there is a serious question of whether to remain in Australia.

Independent, inclusive, long-term leadership – with a view to build social license

Among CEDA’s experts, the view was clear. Independent, long-term leadership on innovation is an urgent priority. But ambition-setting is only part of the challenge. Data, accountability and transparency are critical to governing our ambition. This was recognised in the Australia 2030: Prosperity through Innovation plan and the government at the time, which agreed to implement an Innovation Metrics Review. As yet it does not appear that the draft report from this process which was completed some years ago has been released. This report would provide an important starting point for framing innovation policy frameworks and measures of success.

Further, the need to earn, and maintain public trust through inclusive debate cannot be underestimated.

_1.png)

Science X Technology

to drive Australian innovation and growth

Insights

Collaboration

Diffuse the cultural disconnect between governments, universities and businesses and rebuild a collaborative innovation ecosystem that embraces its many different parts, and is enabled by a common ambition and language.

The Collaboration opportunity

Australia has the fundamentals in place to become an innovation leader. Our governments are democratically elected and stable, our population is well-educated and our business community has appetite to better support and engage in development. However, our existing innovation landscape poses significant barriers for the many stakeholder groups who need to collaborate to maximise our innovation potential.

Collaboration between the three key stakeholder groups (industry, academia, government) is characterised by a lack of a common language, with different priorities, expectations, values, metrics and KPIs. For smaller players, such as small business or entrepreneurs or high net worth individuals seeking to invest, it can be hard to access appropriate collaborators. In the absence of a unifying vision, the three groups struggle to connect effectively. Examples can be seen in language (for example, ‘grants’ vs ‘investments’), debate over the value of pure vs applied research, dispute over intellectual property rights, lack of understanding and exposure for stakeholders within one sector to the skills of those in the others and different metrics used in each sector for assessing progress and outcomes.

Enablers of improved collaboration

A common language for describing innovation work and funding

Even between the science and technology communities, there is a difference in how research and development work is approached and described.

Grants should come with KPIs, even NHMRC and ARC grants should have some level of KPIs and accountability and they’re not just giving the money away.

Develop common metrics for gauging innovation progress and value.

A unified national ambition calls for meaningful metrics that support its success.

Almost all Australian research starts in the higher education sector, which accounts for 90 per cent of basic research conducted. The higher education sector is the strongest contributor to the overall growth of R&D in Australia. Despite accounting for around one-third of R&D conducted in Australia, the university’s mandate is not to commercialise.16 Instead, universities emphasise volume of publications in their KPIs. This means the university sector is not financially incentivised to support research commercialisation or translation and researchers may risk their academic careers by pursuing commercialisation if it comes at the expense of their publication output.

Conversely, outside of higher education, start-ups gauge success in more brutal operational terms: funding achieved, bills paid, product delivered. In this environment progress is approached with a fast-fail mentality. Fast failure emphasises the value of testing and incremental development, where pivoting occurs quickly when testing reveals an approach is not working. In the emphasis it places on experimentation, the fast-fail mindset is comparable to the scientific method itself. In both instances, failure ideally feeds back into the research as valuable data for future projects.

One of the most significant metrics of value missed by a focus on income and expenditure is the potential for technological, scientific and commercial spillover. This spillover comes from solutions developed in the course of a project that were not the initial goal but have further potential applications. In the defence industry, analysis of the SAAB Gripen fighter project in Sweden found the value of the combined spillover effects of developing the aircraft domestically (e.g. jobs created etc) exceeded the cost of the project to the taxpayer.17

The space industry presents another example. NASA generates a total economic output of more than US$64 billion in a single fiscal year with a budget of US$21 billion.18 The federal government has a long overdue review of innovation metrics, the first step towards creating a framework for consistently measuring spillover effects so the true value of research and development investment can be captured.

Update attitudes to IP

As a critical contributor to R&D and therefore intellectual property in Australia, it is understandable that deriving benefit from IP generation and use is important to universities in Australia. However, this is an area frequently cited by industry as a barrier to better collaboration with universities. Anecdotes abound of time taken to negotiate and enforce complex IP contractual arrangements.

Practice is evolving in ways that are more conducive to collaboration. For example, universities adopting generally ‘open’ approaches, and businesses learning that models with IP either entirely owned by universities or entirely funded and therefore owned by them are easier paths forward. Similarly, there are examples from leading US universities, where academics are encouraged to commercialise and allowed to benefit largely and directly from that.

As key members of the national innovation ecosystem team, it is important that universities are encouraged to evolve and share best practice regarding IP management and use, and that business does likewise in terms of successful sharing of learnings on how to collaborate to impact with researchers and universities.

_1.png)

Science X Technology

to drive Australian innovation and growth

Insights

Capability

The question of capability needs to be considered on many levels – from individual, to institutional, to national. From building SxT confidence in girls and boosting female participation in SxT professions to increasing SxT literacy in boardrooms and bolstering sovereign IP, Australia faces some important choices on building capability in pursuit of a more innovative economy.

The Capability opportunity

STEM occupations make up 21.9% of total employment in Australia and fell by only 1.5 per cent during the pandemic, compared with a 6.9 per cent decrease for non-STEM occupations. Future employment in STEM occupations is projected to grow more than twice as fast as non-STEM occupations.19 In its 2017 National Science Statement, the Department of Industry, Science, Energy and Resources (DISER; now the Department of Industry, Science and Resources) noted businesses that innovate are twice as likely to use STEM skills, while 70 per cent of Australian employers identify STEM‑skilled employees as the most innovative.20

Given the importance of developing these skills to a leading standard, there remains an elephant in the room.

From the earliest years, the perception of STEM is impacted by a gender lens. The 2020-21 STEM Equity Monitor, published by the Department of Industry, Science and Resources, showed that the majority of educators believe boys and girls are equally confident in mathematics, science and technology. However, across all STEM subjects, where educators perceived a gendered difference in confidence this was heavily skewed towards boys. This skew is most prominent with engineering with almost two thirds of educators (61%) believing boys are more confident than girls.

Looking to employment data, women remain significantly underrepresented in science and technology jobs. Despite the huge opportunity associated with STEM skills, women and girls, Indigenous Australians, and those in rural and regional areas have lower participation rates in science x technology jobs. 21, 22

Figure 2

Interest in stem subjects

Source: YouthInsight 2020-21, STEM Equity Monitor, Department of Industry, Science and Resources

The challenge around STEM knowledge is visible in boardrooms too. Even for businesses not directly involved in technology, STEM knowledge is still crucial for creating decision-making capacity around technological capability. In small- to medium-enterprise operations, the diversity of board capital (knowledge and relationships) has been shown to be a driver of innovation and firm performance.23 For venture capital and investment businesses, STEM knowledge is also a crucial component of building a more innovation-friendly environment, given Australia’s private capital market is comparatively small.24 In Australia, the ‘STEM-literate’ investor remains an exception.

On the flip side, commercial literacy is lacking in research communities too.

Balancing the low levels of STEM literacy in Australian business, is a corresponding challenge for innovation communities. Exposure to commercial thinking, expectation and frameworks – as well as government policy – can be limited for researchers and entrepreneurs. Science & Technology Australia describes this challenge in terms of ‘Bench to Boardroom and Boardroom to Bench’. A report released by STA on 29 August 2022 suggested a modest investment in such a program could lead to a windfall of $52 billion.25

Enablers of innovation Capability

Our experts agree that the challenge around STEM is a wicked one. But what if STEM were recast not as ‘science, technology, maths and engineering’, but as essential core skills needed to solve a wide variety of problems and enable future Australians to thrive? This would provide a less literal line to set fields of employment, which could address some of the preconceptions around STEM. One of the challenges for students today, especially those interested in problem-solving and innovation, is building skills that will be flexible enough to apply to future roles.

You have to be comfortable with the uncertainty that the role you may be going into doesn’t as yet exist.

Building on that thinking is a strong view that Australia may be underdeveloped in its STEM teaching and industry around so-called ‘soft’ skills.

A degree or a series of micro-credentials?

Our experts also agree that evolving further education models – and in particular the rise of the micro-credential as an ongoing development tool – offers a more agile approach to upskilling a workforce that needs to adapt quickly to new capabilities.

The World Economic Forum’s The Future of Jobs Report 2020 in partnership with LinkedIn found that among the transitions into Data and AI professions, 50 per cent of the shifts made came from non-emerging roles.

The majority of transitions into the “jobs of tomorrow” come from non-emerging jobs - proving that it is not only possible, but quite common.

Figure 3

Job pivots by skills similarity with source occupation

Source: LinkedIn Economic Graph, The Future of Jobs Report 2020

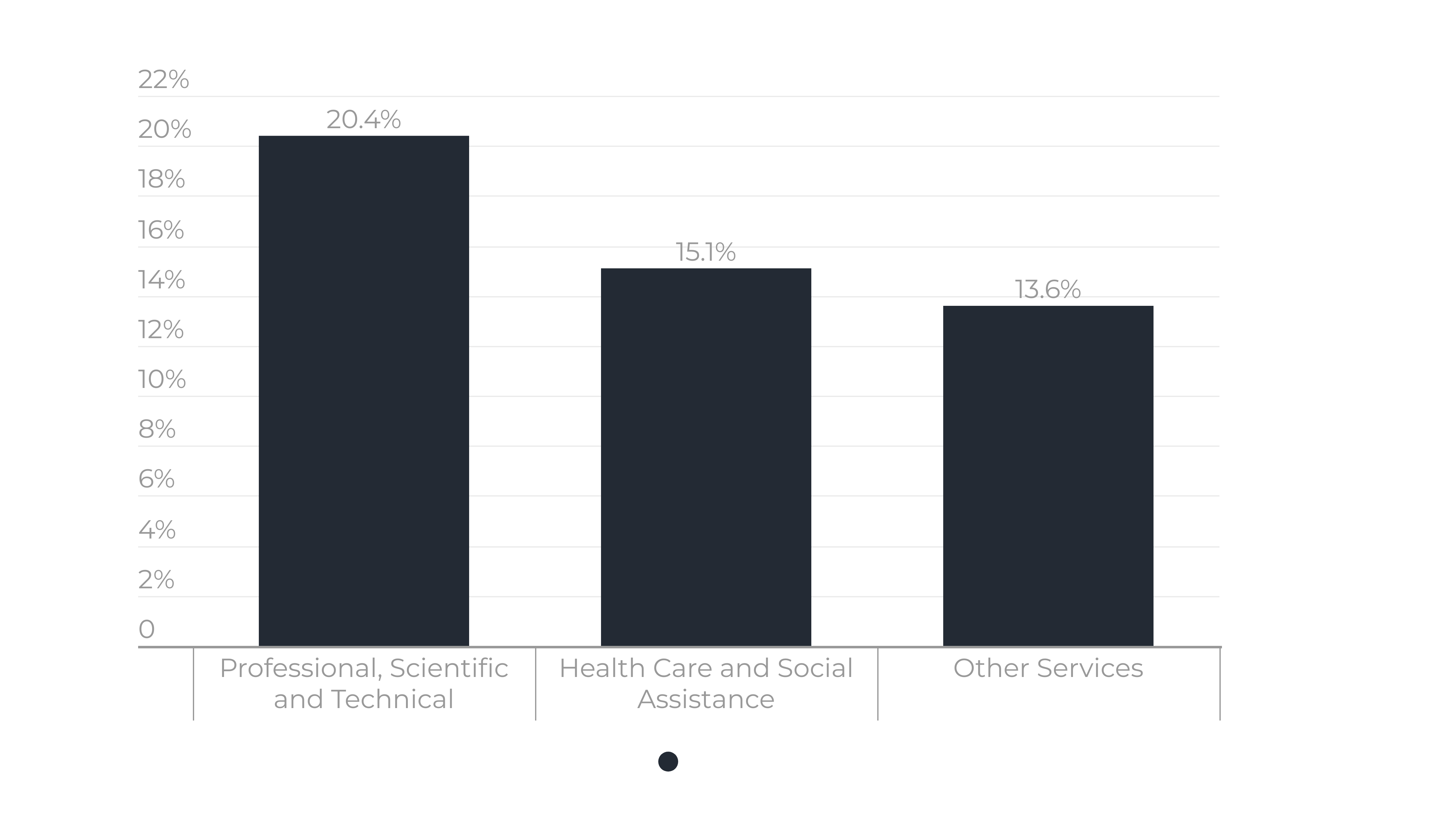

The role of skilled migrants

Immigration must be viewed and communicated as a strategic supplement to domestic capabilities. Despite being an international hub for higher education, Australia is a high importer of science and technology skills with the professional, scientific and technical industry accounting for 20 per cent of the skilled visa sponsorships in the 2021-22 program.26 The need to remain an attractive location for increasingly sought-after skills is critical for Australia.

And can we do better with boomerang workers? How do we lure expats home? While the science and technology sectors in Australia may not be developed enough to compete with global hubs like Silicon Valley in terms of salary, Australia does offer a more attractive lifestyle, job satisfaction and work/life balance that our expatriates are eager to access. From a productivity and innovation perspective these people are invaluable, bringing different perspectives, advanced skills and new ways of working.

Figure 4

PRIMARY VISAS GRANTED – TOP THREE SPONSOR INDUSTRIES (2021-22)

.png)

Source: Temporary resident (skilled) report 31 March 2022, Australian Department of Home Affairs

Maybe we call them our own domestic boomerangs, the women in the workforce who left the workforce and could come back. Maybe they’re not going to have the most up-to-date skills, but they will have the competencies and capabilities that could underline that.

Normalise the separation of an idea from its inventor when it comes to translation

What attracts people to code in their garage or undertake a career in academic research can be fundamentally different to what attracts people to a career in industry. The best researchers are unlikely to be the best entrepreneurs. Policy should aim to provide the cohort of academics who are entrepreneurial with the opportunities, resources, metrics and skills to pursue commercialisation.

By expanding academic career opportunities and, in some streams, reducing the emphasis on publications in favour of more innovation-focused measures, universities could boost their ability to both generate new research and improve commercialisation outcomes.

Intellectual Property, sovereign capability and commercialisation rights

In recent years, heightened by the return to more nationalistic global markets and the COVID-19 pandemic, the issue of sovereign capability has gained prominence in national debate. This tension was clearly illustrated in late July 2022 (as this report was being prepared) when Science and Innovation Minister Ed Husic sought clarity from four major Australian universities around a major quantum computing industry partnership. “The government needs to be funding that kind of research and I’m determined to develop a sovereign quantum computing capability here,” Mr Husic told the Australian Financial Review. “We don’t want this to be like solar technology, where we were pioneers until it went offshore and we lost much of the environmental and economic benefits.”

Challenges around the ownership of IP go beyond the sovereign capability level too.

We don’t need all 90,000 of our scientists and technologists in our network to become lead commercialisers. But if we could find 2,000 of them who wanted to really lean into this, we could make a powerful cultural difference to the country.

Building innovation capabilities with business

Working as part of an ecosystem that involves multiple external stakeholders focused on shared goals is a different way of working for many within business. Building the skills to collaborate and adopt ‘agile’ ways of working should be a priority for those looking to innovate successfully. By way of anecdote, one CEDA member organisation reported that it took three years for the ‘culture’ of the technology team to permeate the rest of the organisation.

_1.png)

Science X Technology

to drive Australian innovation & growth

Methodology and contributors

The findings presented in this report are based on a series of facilitated workshop discussions with key stakeholders and CEDA members. The workshops were designed and delivered by CEDA. Conclusions and insights drawn from the workshops are the responsibility of CEDA. This report has been prepared with the support of CEDA’s project partners Microsoft.

CEDA undertook a series of roundtable workshops in May and June 2022 to gain qualitative insights on opportunity for Australia to better harness Science x Technology to better drive innovation and economic growth. These insights are intended to complement broader work and surveys undertaken by others, including:

University Research Commercialisation Action Plan

‘Our Future World’ CSIRO Megatrends Report July 2022

Australia 2030: Prosperity through Innovation (November 2017)—ISA’s strategic plan for the innovation system, contained 30 recommendations for action across education, industry, government, research and development, and culture and ambition.

The workshops were focused in four areas:

- Generating Science x Technology ideas

- Commercialising Science x Technology ideas

- Building a generation of Science x Technology entrepreneurs

- Leading and governing an innovative nation

The focus of discussions was to bring together leadership across science, technology, traditional and new industry, academia and government to understand the current state of play in Australia as regards innovation, and what changes we might make to supercharge our success between now and 2050.

Feedback was both verbal and written, with facilitators and participants sharing information online in real-time, and via emails. There was also a follow-up workshop with selected participants tested and refined the findings from the original discussions.

The findings in this report do not proport to be a comprehensive or statistical representation of the state of play. They are intended to reflect the scope of progress and to highlight challenges, and in doing so, spark conversation and discussion around how progress towards a sustainable innovation pillar for the Australian economy can be enabled and accelerated. Roundtables included participants from across academia, business and government, as well as entrepreneurs, financiers and independent agencies. It is important to note that by virtue of participating in the workshops, participants are likely to represent organisations more engaged on the issues of improving innovation in Australia (i.e. positive self-selection).

Contributors in alphabetical order

Jarrod Ball, Chief Economist, CEDA

Professor Joanna Batstone, Director, Monash Futures Institute

Gordon deBrouwer, PSM

Rossana Bianchi, Responsible Artificial Intelligence Lead ANZ, Applied Intelligence, Accenture Australia and New Zealand

David Burt, Director Entrepreneurship, UNSW

Melinda Cilento, CEO, CEDA

Jeff Connolly

Emily Chang, Partner & Co-Founder, Cruxes

Innovation

Graeme Dunk, Head of Strategy, Shoal Group

Bronwyn Fox, Chief Scientist, CSIRO

Jan Haak, General Manager Australia, First Mode

Sophia Hamblin-Wang, Chief Operating Officer, Mineral Carbonation International

Lee Hickin, Chief Technology Officer, Microsoft

Professor Mark Hutchinson, President, Science & Technology Australia

A/Prof Jia-Yee Lee, Enterprise Fellow in Medtech, University of Melbourne

Dr Audrey Lobo-Pulo, Senior Public Policy and Economic Graph Manager, ANZ, LinkedIn

Geoff Mason, a/g General Manager, Technology, Policy and Engagement, DISER

Tom McMahon, Chief of Staff, Technology Council

Michael Molinari, Managing Director IPG Australia

Megan Motto, CEO, Governance Institute of Australia

Professor Andrew Parfitt, Vice Chancellor,

University of Technology Sydney

Professor Goran Roos

Kirsten Rose, Executive Director Future Industries, CSIRO

Dr Olivier Salvado, Lead, AI for Missions, Data 61

Renae Sayers, Deputy Director, Space Science and Technology Centre, Curtin University

Misha Schubert, CEO, Science & Technology

Australia

Diane Smith-Gander, AO, National Chair, CEDA and Non-Executive Director

Professor Sharath Sriram, RMIT

Vicky Staikopouos, Co-founder, Woven Optics

Andrew Stevens, Chair, Industry Innovation and Science Australia

David Thodey AO, Global Business Leader

Professor John Whittle, Director, Data 61

Steven Worrall, Managing Director, Microsoft Australia & New Zealand

Tiffany Wright, Director Education, Microsoft Australia

Judith Zielke PSM, CEO Australian Research Council

References

1. https://www.csiro.au/en/research/technology-space/data/our-future-world

2. Science and Innovation:

• Science and Industry Research Act 1949

• Science and Industry Endowment Act 1926

• Mutual Recognition Act 1992, except to the extent administered by the Minister responsible for Employment

• Pooled Development Funds Act 1992

Education:

• Australian Research Council Act 2001

3. https://www.nber.org/papers/w27863

4. https://www.innovationaus.com/industry-portfolio-must-be-at-the-centre-of-government/

Industry portfolio must be at the centre of government (innovationaus.com)

5. 2021–22 Science, Research and Innovation (SRI) Budget Tables

6. 200917-HE-Facts-and-Figures-2020.pdf (universitiesaustralia.edu.au)

7. https://data.oecd.org/rd/gross-domestic-spending-on-r-d.htm

8. https://publications.industry.gov.au/publications/australianinnovationsystemmonitor/executive-summary/index.html

9. University Research Commercialisation Action Plan - Department of Education, Skills and Employment, Australian Government (dese.gov.au)

10. University Research Commercialisation Action Plan - Department of Education, Skills and Employment, Australian Government (dese.gov.au)

11. https://doi.org/10.25919/k9tj-h786

12. Steve Blank Why The Government is Isn’t a Bigger Version of a Startup

13. https://www.nber.org/papers/w27863

14. https://www.dfg.de/en/research_funding/programs/excellence_strategy/index.html

15. Europe’s path to decarbonization | McKinsey

16. ESE21-0043 University Research Commercialisation Action Plan_ACC_04.pdf

17. Advanced Public Procurement as Industrial Policy: The Aircraft Industry as a Technical University, 2010, Eliasson, Gunnar

18. National Aeronautics and Space Administration & Moon to Mars Program Economic Impact Study

19. National Skills Commission Annual Report 2020-2021

20. Australia’s National Science Statement (industry.gov.au)

21. Australia’s National Science Statement (industry.gov.au)

22. STEM-qualified occupations | Department of Industry, Science and Resources

23. https://doi.org/10.1002/smj.2792

• https://doi.org/10.1002/smj.907

• https://doi.org/10.1108/MD-06-2017-0594

• https://doi.org/10.1016/j.jbusres.2009.03.012

24. Preqin-Markets-in-Focus-Alternative-Assets-in-Australia - FINAL Report.pdf (aic.co)

25. https://scienceandtechnologyaustralia.org.au/reports-and-publications/

26. https://www.homeaffairs.gov.au/research-and-stats/files/temp-res-skilled-rpt-summary-310322.pdf