26/04/2022

The World Economic Forum recently reported that Australia fell from 12th to 70th in the world in economic opportunity and participation for women, despite having the highest educational attainment rates for women. This presents stark economic implications not only for women, but for the nation as a whole in the context of our rapidly escalating structural ageing problem.

Social changes have brought an unrelenting decline in fertility rates and medical advances have increased life expectancy, so that in the coming decades most of the Australian population will be over the age of 55. With an ageing population comes upward pressure on health care costs and welfare payments, and a concurrent decline in the proportion of people of labour force participation age. Less people participating in the labour force generates lower taxation revenue, and limits economic growth that is needed to finance the increased governmental expenditure. As such, maximising employment in those of labour force participation age has never been more important.

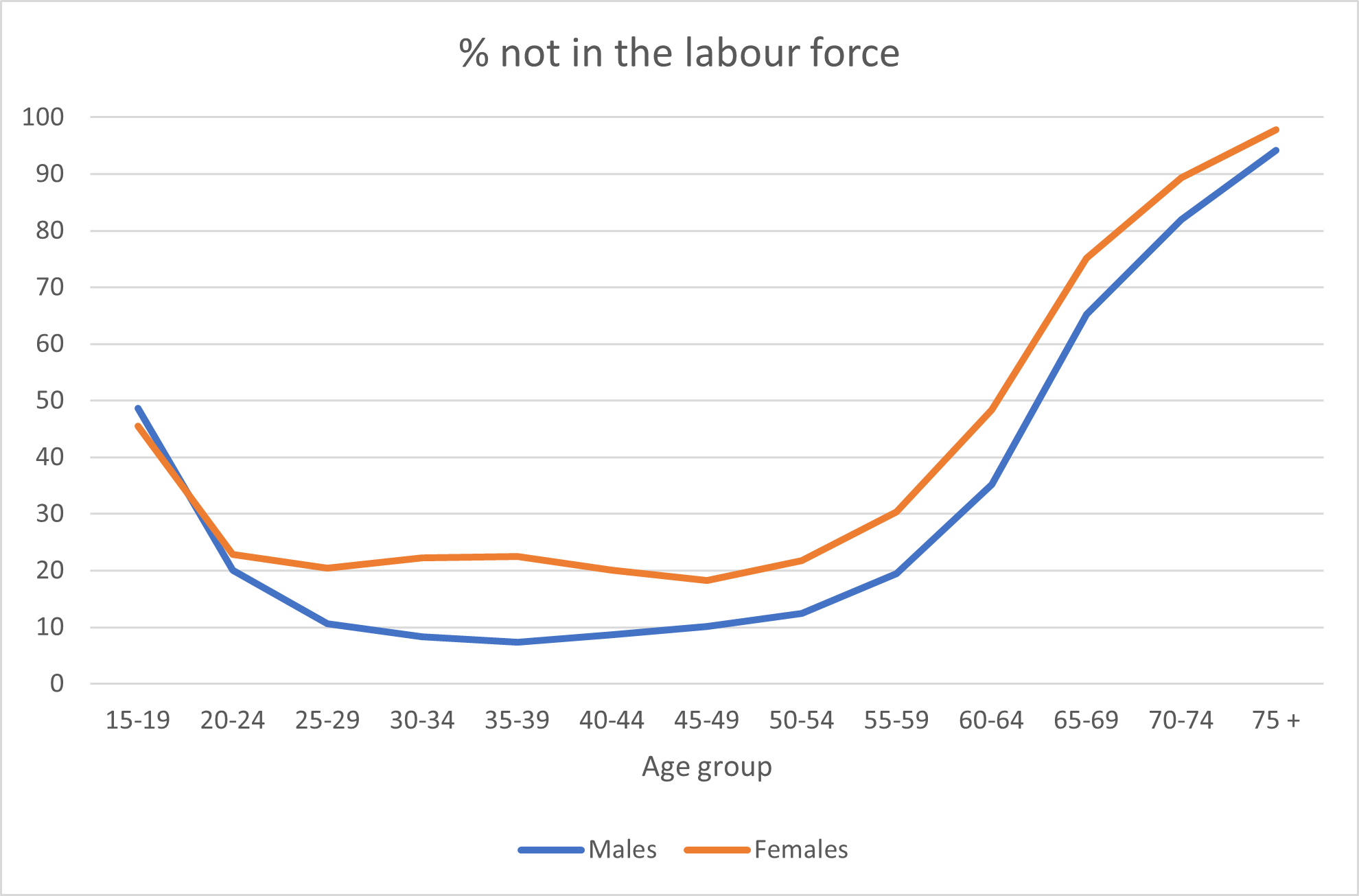

The Australian full employment rate is only 72 per cent, but with an eight percentage point gender difference. Only 68 per cent of women were participating in the labour force; 2.7 million Australian women are missing from the labour force. Across the life-course, women face an employment gap. This begins at age 20– 24, widens in the late 20s through to the 30s and 40s – the parenting years – and is never closed across all age groups (Figure 1). The peak gender difference is between 35–39 years, where 23 per cent women are not in the labour force compared to seven per cent of men. The annual national cost of women’s labour force absence and unemployment is $72 billion in lost GDP.

For women themselves, labour force absence comes at enormous individual cost through lower income, increased poverty risk, and over time, significantly lower wealth accumulation. To illustrate the magnitude of the impact that being out of the labour force has on women’s long-term wealth, on average, women who were able to maintain full time employment until they reach age 65 accumulate $463,101 in wealth assets and men who maintain full time employment accumulate $946,557. For those with health challenges, such as those who leave the labour force due to mental health conditions, women aged 65 have wealth assets (including superannuation) valued at $7,020 on average, compared to men with $19,904. Overall, women are at significantly increased risk of financial hardship during retirement, as a function of lower labour force participation over their working age years, and are increasingly denied a fair and financially comfortable retirement in Australia.

It is overwhelmingly clear that consideration of the gendered difference in labour force participation must be at the forefront in government policy decisions. Yet current government policies focused on superannuation and taxation appear to be widening the wealth inequality between Australian men and women. Of the current superannuation balances, 61 per cent is held by men and only 39 per cent by women. The recent budget announcement to extend the Supporting Retirees policy disproportionately benefits males. In contrast, the introduction of superannuation payments for parental leave would have reduced inequality in wealth between men and women. Until this happens, Australia’s compulsory superannuation policy will continue to widen the gender wealth gap.

In addition to meaningfully reducing gendered inequalities in wealth, the lower rate of women’s labour force participation must be addressed and will require policies to remove the gendered barriers to participation that women face. Caring for children is the most cited reason for women who are not in the labour force and not looking for work. Of women who would like a job or want more hours, 48 per cent cited caring for children as the main barrier (compared to three per cent of men). The two most common incentives that women report to enable their participation in the labour force are access to childcare places (52 per cent of women stated this was very important) and financial assistance with childcare costs (51 per cent of women stated this was very important). The Grattan Institute found that a universal childcare subsidy and associated access would cost $10 billion per year, but return $24 billion in increased GDP by facilitating greater labour force participation for women.

Overall, gendered inequality in labour force participation comes at enormous cost to women with widening inequity in superannuation and wealth accumulation. It also comes at great cost to Australian society through foregone economic growth. Enabling women’s labour force participation requires addressing barriers women currently face, which are overwhelming tied to having and raising children. Government policies must prioritise the removal of barriers women face to labour force participation and actively work to close the gaps in gendered labour force participation, superannuation and wealth accumulation. Until this happens any policy that produces economic benefit primarily for those participating in the labour force, such as tax cuts or increased superannuation limits, will actively widen the economic inequality gap between men and women.

Associate Professor Emily Callander, Dr Rhonda Garad, Dr Joanne Enticott, Professor Helena Teede

Monash Centre for Health Research and Implementation, Monash University

World Economic Forum, Global Gender Gap Report 2021. 2021, World Economic Forum: Geneva.

Auer, P. and M. Fortuny, Ageing of the labour force in OECD countries: Economic and social consequences. 2000: International Labour Office Geneva.

Commission, P., Economic implications of an ageing Australia. Productivity Commission, Government of Australia Research Reports, 2005.

Commission, P., Efficiency in health. 2015.

Australian Institute of Health & Welfare, Australia’s Welfare. 2021, AIHW: Canberra.

Treasury, Intergenerational Report, 2007. 2007, Australian Government: Canberra.

Australian Bureau of Statistics, 6291.0.55.001 Labour Force, Australia, Detailed. 2022, ABS: Canberra.

Callander, E.J., D.J. Schofield, and R.N. Shrestha, Multi-dimensional poverty in Australia and the barriers ill health imposes on the employment of the disadvantaged. The Journal of Socio-Economics, 2011. 40(6): p. 736-742.

Schofield, D., et al., The economic impact of diabetes through lost labour force participation on individuals and government: evidence from a microsimulation model. BMC public health, 2014. 14(1): p. 220.

Schofield, D., et al., The costs of being a carer: labour force participation and lost earnings among older working aged Australians. Australian and New Zealand Journal of Public Health, 2013. 37: p. 192-193.

Schofield, D.J., et al., Labour force participation and the influence of having CVD on income poverty of older workers. International journal of cardiology, 2012. 156(1): p. 80-83.

Schofield, D.J., et al., How depression and other mental health problems can affect future living standards of those out of the labour force. Aging & mental health, 2011. 15(5): p. 654-662.

Committee, S.E.R., 'A husband is not a retirement plan': Achieving economic security for women in retirement. 2016: Parliament of Australia.

Clare, R., Superannuation account balances by age and gender. 2017, Sydney: Association of Superannuation Funds of Australia Limited.

Australian Bureau of Statistics, 62200TS0014 Persons Not in the Labour Force, Australia - Main reason not actively looking for work. 2014, ABS: Canberra.

Australian Bureau of Statistics, Barriers and Incentives to Labour Force Participation, Australia. 2020, ABS: Canberra.

Wood, D., K. Griffiths, and O. Emslie, Cheaper childcare: A practical plan to boost female workforce participation. 2020: Grattan Institute.