Explore our Climate and Energy Hub

Back to all opinion articles

31/03/2019

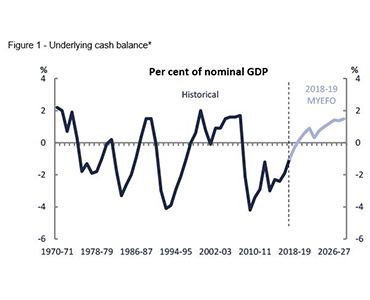

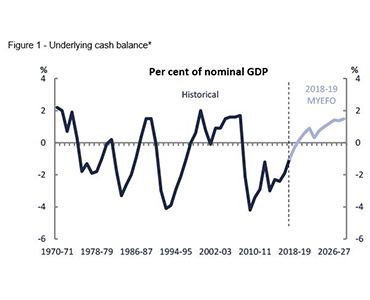

Public statements from the federal Government affirms that a surplus (Figure 1) is going to be delivered on 2 April; but should we be excited by the prospect of a Budget surplus?

We recently polled over 1000 members of the public and asked them how they would prioritise the upcoming Commonwealth Budget in terms of their preferred emphasis on spending and taxing. The number one preference was around small government, that is, lower taxes and lower government expenditure.

The public views on the economic outlook for the country are dour; with almost 60 per cent believing the economy will be worse or the same in the next two years. The Government can point to the surplus as a sign of successful financial management.

For many Australians, wages growth, job security, and the cost of living are the priorities and the Government will need to balance these worries with the country’s future prosperity, especially at a time when oncoming concerns are prevalent.

The difficulty is that the Government would be wrong to go rushing headstrong into claiming this surplus as a victory and be tempted to waste a good surplus with short-term approaches.

With the onset of the GFC in 2007–08 we saw tax receipts fall (Figure 2) as:

Correspondingly, we saw government spending increase as welfare payments increased and the Government sought to pump-prime the economy with additional spending.

It is fair to say that Josh Frydenberg is expected to preside over a Budget surplus this year through a combination of luck and some prudent economic management.

On the expenditure (payments) side we have seen improved spending restraint, in part aided by the strong labour market which has reduced the call on welfare spending.

On the revenue (receipts) side:

*2018–19 Mid-Year Economic and Fiscal Outlook Snapshot Figures 1 and 3 provided by Parliament of Australia

We recently polled over 1000 members of the public and asked them how they would prioritise the upcoming Commonwealth Budget in terms of their preferred emphasis on spending and taxing. The number one preference was around small government, that is, lower taxes and lower government expenditure.

The public views on the economic outlook for the country are dour; with almost 60 per cent believing the economy will be worse or the same in the next two years. The Government can point to the surplus as a sign of successful financial management.

For many Australians, wages growth, job security, and the cost of living are the priorities and the Government will need to balance these worries with the country’s future prosperity, especially at a time when oncoming concerns are prevalent.

The difficulty is that the Government would be wrong to go rushing headstrong into claiming this surplus as a victory and be tempted to waste a good surplus with short-term approaches.

Budgetary position

To answer why they shouldn’t look at short-term fixes we need to understand how the budgetary position has changed since the Global Financial Crisis (GFC).With the onset of the GFC in 2007–08 we saw tax receipts fall (Figure 2) as:

- corporate profits fell

- unemployment rose.

Correspondingly, we saw government spending increase as welfare payments increased and the Government sought to pump-prime the economy with additional spending.

It is fair to say that Josh Frydenberg is expected to preside over a Budget surplus this year through a combination of luck and some prudent economic management.

On the expenditure (payments) side we have seen improved spending restraint, in part aided by the strong labour market which has reduced the call on welfare spending.

On the revenue (receipts) side:

- It has taken longer than originally expected for corporate profits to recover to pre-GFC levels, in part because losses were carried forward for so long. Now those losses have been accounted for, corporate profits are on a more solid footing generally.

- We have seen a second wind in the mining boom with resources prices bouncing back to prop up that sector and increase the Government’s tax take. Specifically, even the December Mid-year Economic and Fiscal Outlook (MYEFO) estimates of the iron ore price underestimate what we see in the market and hence will boost tax receipts by just over $2 billion in 2018–19 and just under $7 billion in 2019–20. Furthermore, the Australian Dollar, which is averaging below the MYEFO assumed rate, could increase tax receipts even more.

Prudent savings

In a time when there is a real concern about oncoming headwinds squirrelling some additional funds away becomes increasingly important. This is not about saving for saving’s sake; it is about:- being able to save so that when there is a major downturn the Australian Government has ready access to funds to stimulate the economy, as it did in the GFC

- ensuring that future generations are not required to unduly subsidise the lifestyle of our current generation of taxpayers.

- bracket creep. The last major tax cuts a decade ago took the average tax rate on personal incomes to 15.6 per cent, but this has crept up with wage inflation so that people pay on average 19 per cent this year, and are set to pay 20 per cent over the next two years.

- the need to raise effective wages. Putting after-tax cash in people’s pockets is a much more effective and efficient way to immediately stimulate consumer expenditure (i.e. in preference to an interest rate cut or legislated higher wages).

*2018–19 Mid-Year Economic and Fiscal Outlook Snapshot Figures 1 and 3 provided by Parliament of Australia

CEDA Members contribute to our collective impact by engaging in conversations that are crucial to achieving long-term prosperity for all Australians. Find out more about becoming a member or getting involved in our work today.